Hawaii homeowners are at a high risk for natural disasters due to the island's unique climate. In this case, it is important to have home coverage. This coverage protects your property from damage and loss from fires, theft, earthquakes, landslides, tornadoes and more.

Best Homes Insurance hawaii

Several insurers offer homeowner's insurance in Hawaii. Allstate State Farm and USAA. These companies offer quality coverage and excellent customer service. Whether you're looking for homeowners insurance for your current house or a new one, it's important to get quotes from several companies to ensure you have the right policy.

Cost of Homeowners Insurance hawaii

There is no requirement to buy home insurance in Hawaii, but it can be very helpful to protect your investment in case of disaster. It is often more affordable to buy an insurance policy for your home than to pay out of pocket to repair or cover damage.

Hawaii real estate can be a lifelong commitment. The Aloha market for real estate is very pricey.

You can save money on homeowner's insurance by choosing a lower deductible. If you choose this option, your premium will be lower. However, you'll need to be prepared for a higher out of pocket expense in the event that a claim is made.

If you're choosing a policy deductible, ensure it will be enough to rebuild the house and its contents should a loss occur. Your insurance premiums will be affected by the amount of deductible you choose.

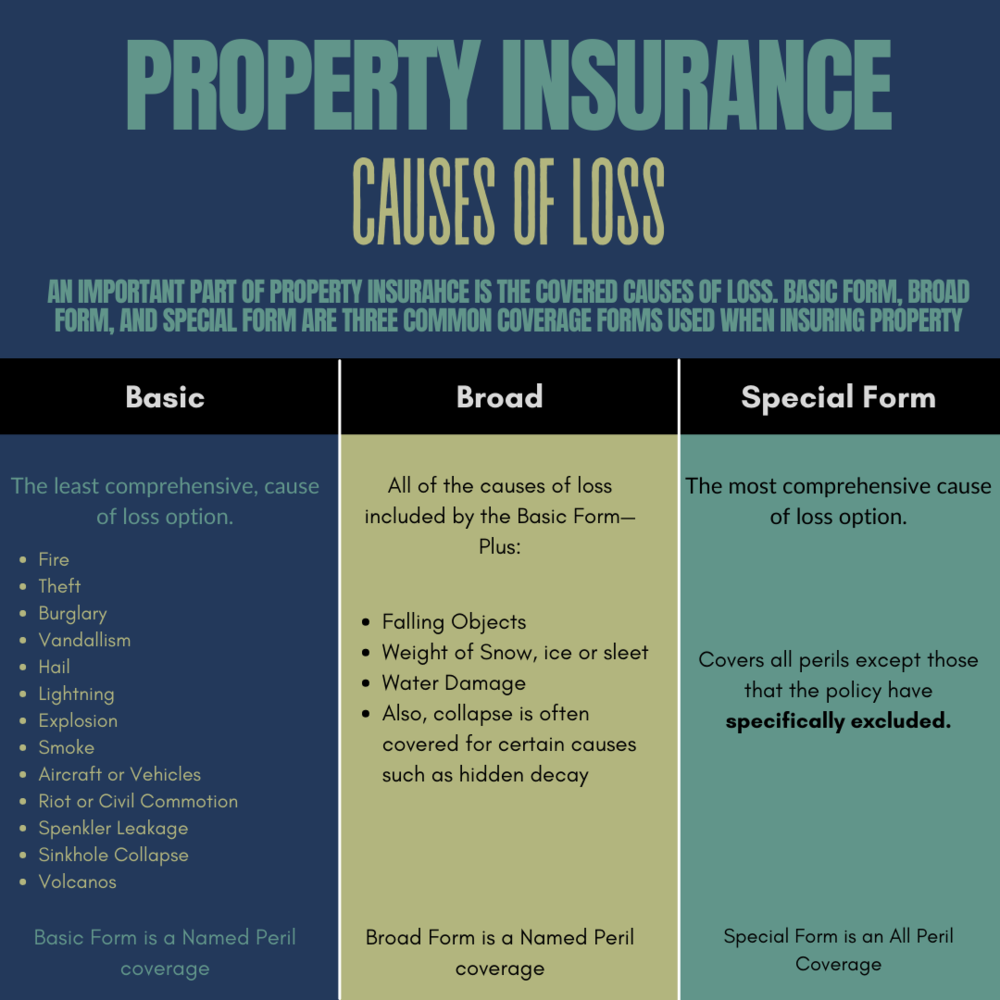

Hawaii homeowners insurance policies usually include three basic types of protection: liability protection, personal belongings and dwelling coverage. Each type of coverage is designed to address the specific needs of different homeowners and home locations.

Coverage for the most basic types of insurance includes the entire house, including the roof, walls, and siding. Some policies also cover personal property and other structures within a property.

Insurers often offer discounts for features and appliances that can help protect your home from damage, like smoke detectors and deadbolt locks. The savings might not be substantial, but over time they add up.

Bundling policies will also reduce your expenses. Most insurers offer discounts if you purchase multiple policies, like home and auto insurance.

In addition to having a stellar reputation, Hawaii home insurers also offer additional discounts based on safety features and a positive claims history. These discounts could be applied to your deductible or policy limit.

Allstate, State Farm, and USAA are the top three insurers in Hawaii for homeowners insurance. Allstate is the most popular choice because of its affordability and high ratings for customer satisfaction. Allstate offers many coverages, including home rentals protection and a military-specific program. The company also has one of the best financial ratings and is one of Hawaii's lowest-priced insurance companies.