To get the best price on your home insurance policy, you should request quotes from several companies. Compare the rates of different policies and evaluate them for cost, coverage and features. Examine third-party reviews for each policy and verify that all documentation has been accurate. Each company uses a different valuation tool, so coverage amounts could vary. Compare similar coverage levels.

Consider these factors when comparing home insurance quotes

When comparing home insurance quotes, there are many things to take into consideration. First, the insurer you choose should be reputable. To determine financial stability, you should look at the rating it has received from independent agencies. You can also check to see if the policy offers bundles, which will allow you to save money by having multiple policies under one policy.

These are important factors to consider. Although it is important to find affordable homeowners insurance, it is just as important to have sufficient coverage. The coverage offered by lower-quality policies is usually less favorable. It is a good idea to get multiple quotes so you can compare the quotes.

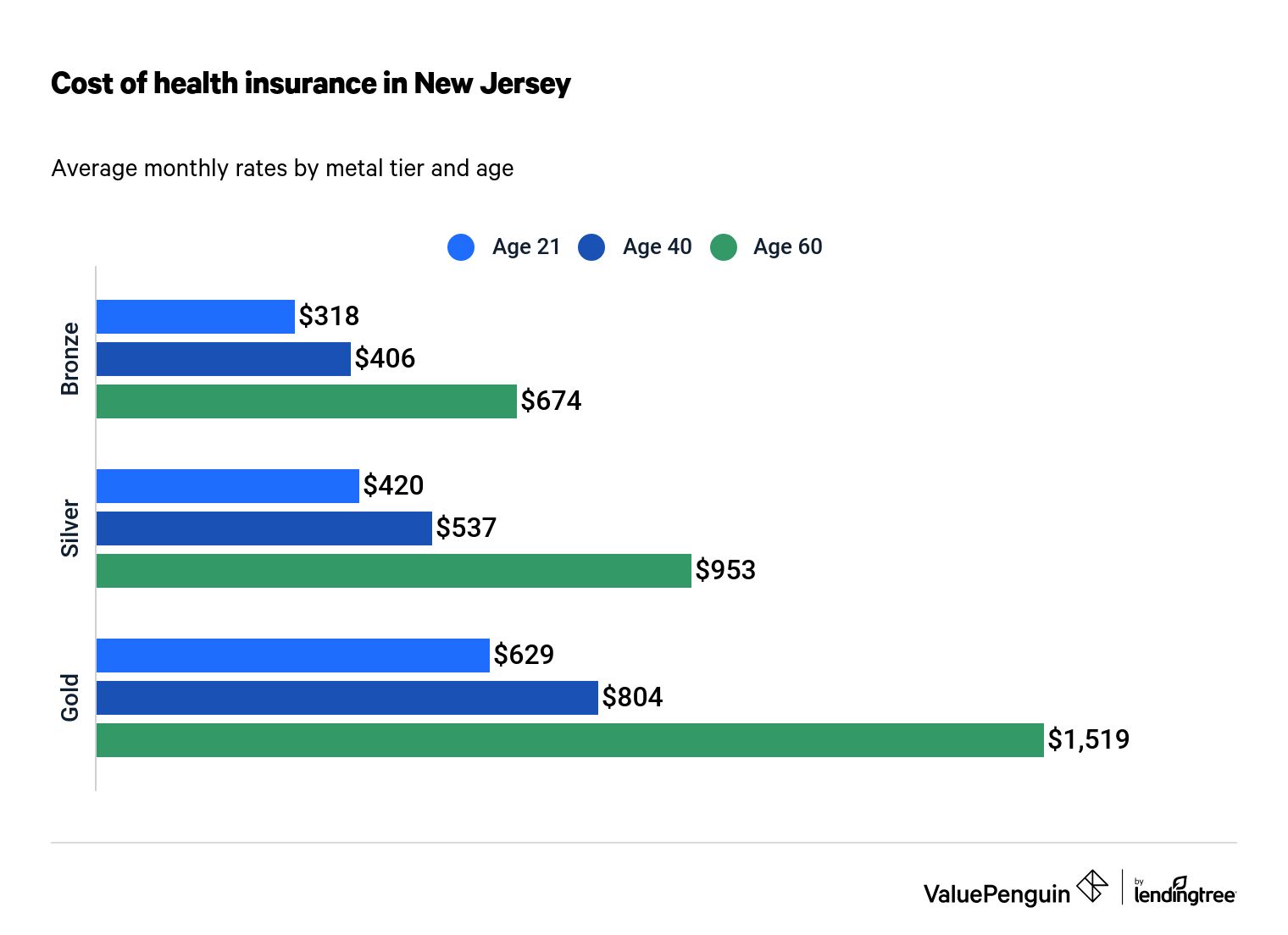

Cost of policy

There are many factors that influence the cost of home-insurance policies. The size of the home, the type of building and the location all play a role in how much the policy costs. A larger home will cost more to insure than a smaller one. Additionally, a house made from costly materials will be more expensive to insure. A home insurance policy covers liability and damage to the building and personal belongings.

Home insurance coverage limits also affect the premium. A standard liability policy covers $100,000 for damages. But, if you need additional coverage, you will have to pay higher premiums. Make sure you understand the deductible that your policy requires before it will pay out. A lower deductible will reduce the cost of your policy and make it more valuable. Home insurance policies can also be affected by renovations, such as adding square footage.

Company's financial strength score

Independent rating agencies have rated insurance companies on the basis of their financial strength. AM Best rates insurance companies on the basis of both quantitative and qualitative factors. These factors are used to give the consumer a full picture of the company’s financial strength. AM Best reviews insurance companies each year and requires them pass certain inspections. The law requires that companies submit financial statements for evaluation every six months. AM Best also has quarterly calls with insurers to evaluate earnings.

Visit the AM Best website to find out a company's financial strength score. Search for "Rating Services" on the AM Best website. Enter the company's name and search the rating. This will give you a number that identifies your insurer's financial strength. You can also access the rating history for the company on the company’s website. This information is available for free.

Customer satisfaction

Home insurance quotes should be compared against each other based on financial strength. Because a company's financial strength determines its ability to pay claims. Independent rating agencies like AM Best can help you assess the financial strength and stability of your insurance company. Ratings that are lower than average are more likely to have problems paying claims and be unreliable. Customer satisfaction is another important factor that will determine a company's financial strength. A good rule of thumb is to select a company with a high customer satisfaction rating.